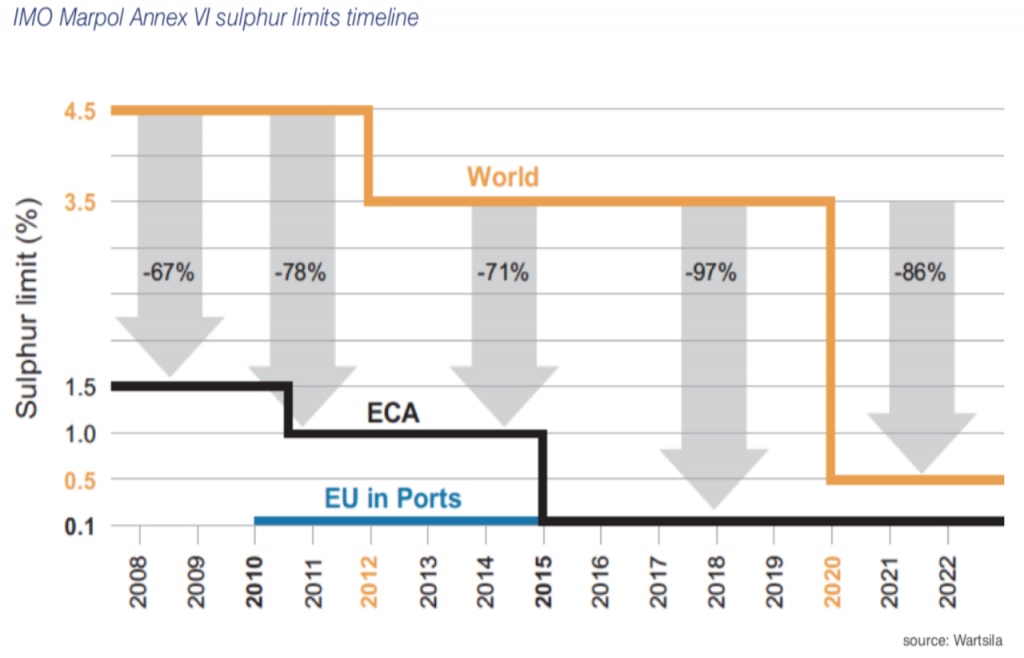

Despite the significance of the change, a surprisingly large proportion of shipping industry players seem to have poor or very poor awareness and understanding of the new regulation according to a survey conducted by global shipping consultancy Drewry. In Drewry’s view, the level of uncertainty today as to the total cost impact is so large that nobody is able to provide a confident forecast of the cost of compliance; the only certainty is that the extra cost will run into billions of dollars globally come 2020. Based on independent “futures” prices, low-sulphur marine fuel prices per tonne will be 55% higher than current high-sulphur fuels.

Considering the commercial operation side of the picture, voyage charterers are normally not much at risk for this new sulphur cap regulation, as they should not hold title to the bunkers. Time charterers generally hold title to the bunkers onboard, and the MARPOL amendment will have an effect on them as well as owners who fix on spot voyage. Under the T/C bunkers clause, charterers normally warrant to be in compliance with MARPOL and may also have given an indemnity to owners for costs, liabilities, fines etc. for breach of MARPOL compliance. From 1 January 2020, MARPOL fines levied on owners may presumably be sought from charterers under a T/C indemnity provision.

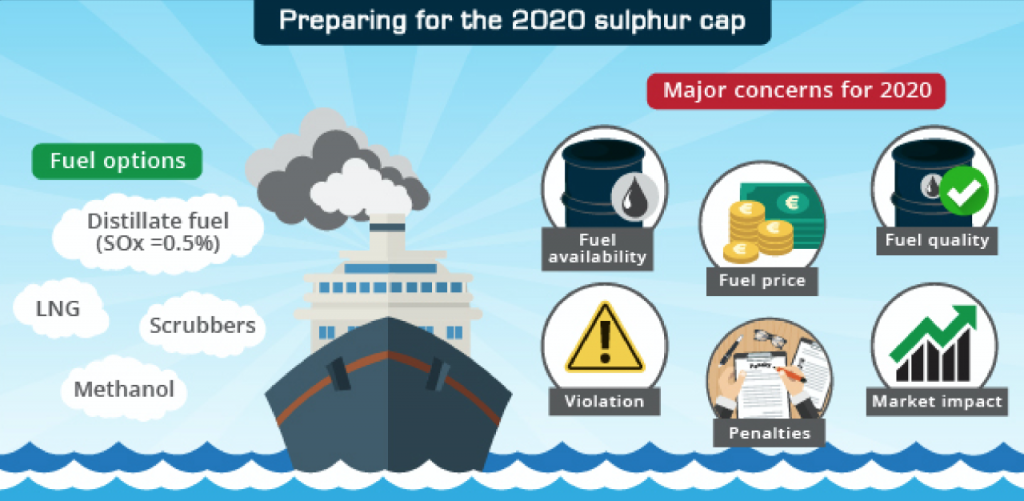

So, all responsible parties have to prepared to take necessary steps in order to prevent potential disputes. Developing a ship-specific implementation plan is necessary to prepare for 1 January 2020. Such a plan should cover at the least issues such as:

- Having a minimum quantity of 0.5% fuel on board by the end of December 2019

- Fuel management on board the ship – co-mingling, compatibility and separation

- Availability of compliant fuel

- Tank cleaning after switching to new fuels

- De-bunkering of non-compliant and residual fuel before the carriage ban (1 March 2020)

- Monitoring and logging emissions

- Charter party issues

Considering all these new changes in shipping industry, as True North Marine we are preparing and improving our services as well. Over the coming months we are releasing version 2.0 of our proprietary software, FleetView. With this new state-of-art software having more sophisticated algorithm in the route optimisation we are in all respect ready to help our customers for their vessels’ weather routing requirements in a best way possible during this transition period in which time, bunker & cost saving will be extremely important.

Fair winds and following seas , bon voyage ….